We are here – rain or shine – working with you as trusted partners and identifying opportunities for your business. We want to grow alongside you.

By providing flexible finance options, we empower companies to realise their potential – to grow, prosper and flourish. We also understand the challenges of business – and our services and insight help you overcome them, fast!

-

We deliver more than just money

-

Our team is made up of trusted industry specialists and experts

We feel we have the best people in the industry. We mix honesty and integrity with a down-to-earth human approach and because we are entrepreneurs too, we understand where you are coming from.

-

We understand the value of people and technology

Our relationships are a core part of our philosophy, so we have created a balance between the old and the new worlds of finance. People, not computers, make our decisions, underpinned by state-of-the-art systems that enables the perfect customer experience. We are transforming the industry through innovation.

-

We deliver more than just money

-

Our team is made up of trusted industry specialists and experts

-

We understand the value of people and technology

Awards —

Sales map —

You can talk to any of our sales managers, but if you want to find one in your region, or one who specialises in a certain sector, please use our sales map to do so.

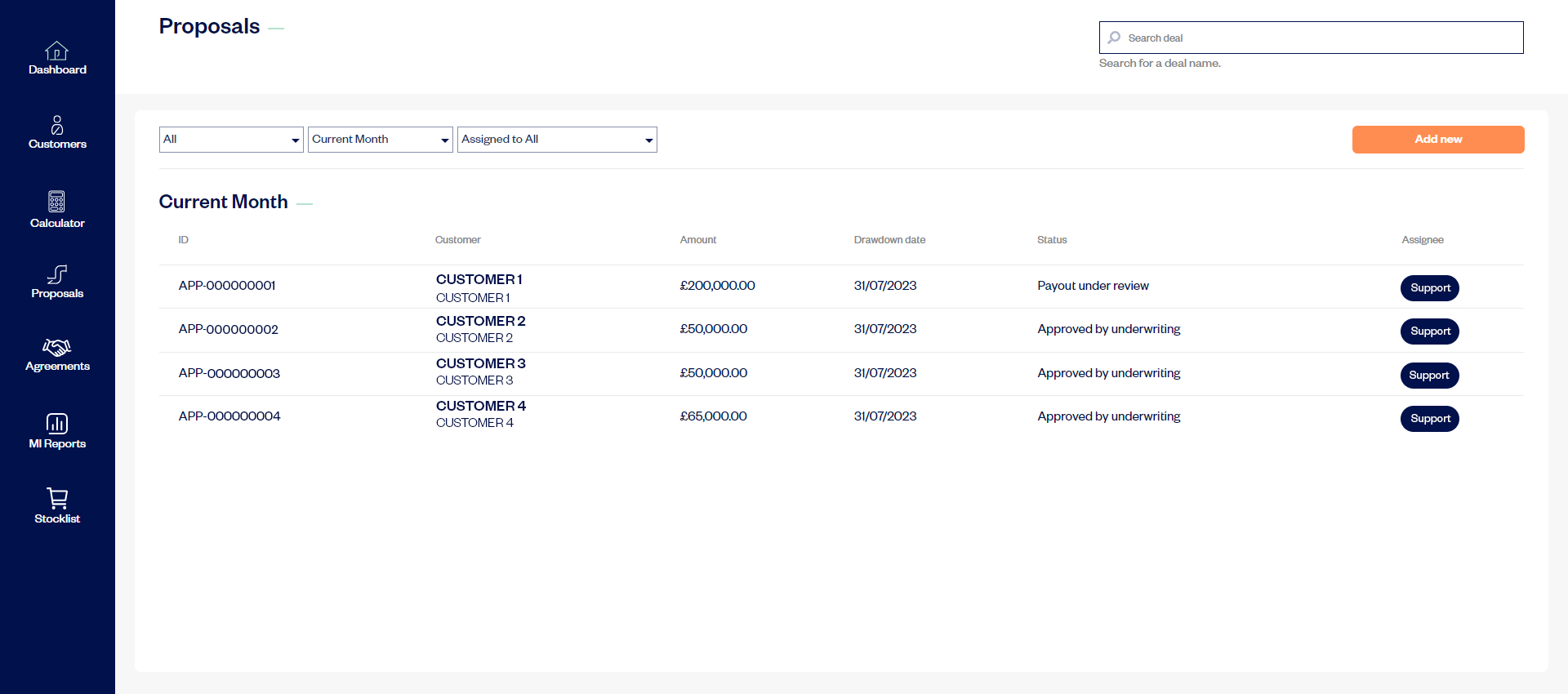

Simply Connect —

Your digital journey to finance

Simply Connect allows customers to manage their funding quickly and easily, from application through to the final payment. We’ve hugely reduced the need for paperwork and manual input – so we’ll have deals loaded and sent through to underwriting in minutes.

Our services —

A simple way to buy an asset and spread the cost over a defined amount of time.

- More flexible than a conventional loan

- Regular monthly payments

- Flexible repayment structure

- Possible tax relief on capital purchases

- VAT can be reclaimed if you’re VAT registered

A finance lease works as a rental agreement. We buy the asset you need and rent it to you over the duration of the lease contract. That means you have it straight away, and only need a fraction of the total amount up front.

- Access equipment quickly without significant initial investment

- Lease payments and periods can be designed to match cashflow

- Decide what to do at the end of the rental period

- Decide what to do at the end of the rental period

Equity release is a finance solution that enables you to raise capital for your business by securing a loan against your high value assets – traditionally machinery, equipment or vehicles.

- Suitable for companies of all sizes

- Consolidate costs and potentially reduce monthly outgoings

- Allows continued use of existing assets whilst introducing working capital back into your business

- Manage cashflow more effectively

- Can be used to raise deposits for or buy new assets such as software that may not be suitable for finance

- Can be used to consolidate existing financial commitments

Hire purchase

A simple way to buy an asset and spread the cost over a defined amount of time.

- More flexible than a conventional loan

- Regular monthly payments

- Flexible repayment structure

- Possible tax relief on capital purchases

- VAT can be reclaimed if you’re VAT registered

Simply Asset Finance reports record financial year as total loan origination to date surpasses £1.75bn

Simply Asset Finance reaches £50m origination in Liverpool office as North West growth accelerates

LGB Capital Markets achieves first £100m MTN Programme with Simply Asset Finance

Follow us on twitter @simplyasset and LinkedIn for our latest news