Frequently asked questions —

Asset finance is a simple method to help businesses acquire equipment to help grow their businesses. That could include purchasing new or used equipment or indeed releasing equity out of equipment already owned. Ultimately, asset finance is a proven product that assists businesses with cash flow and growth.

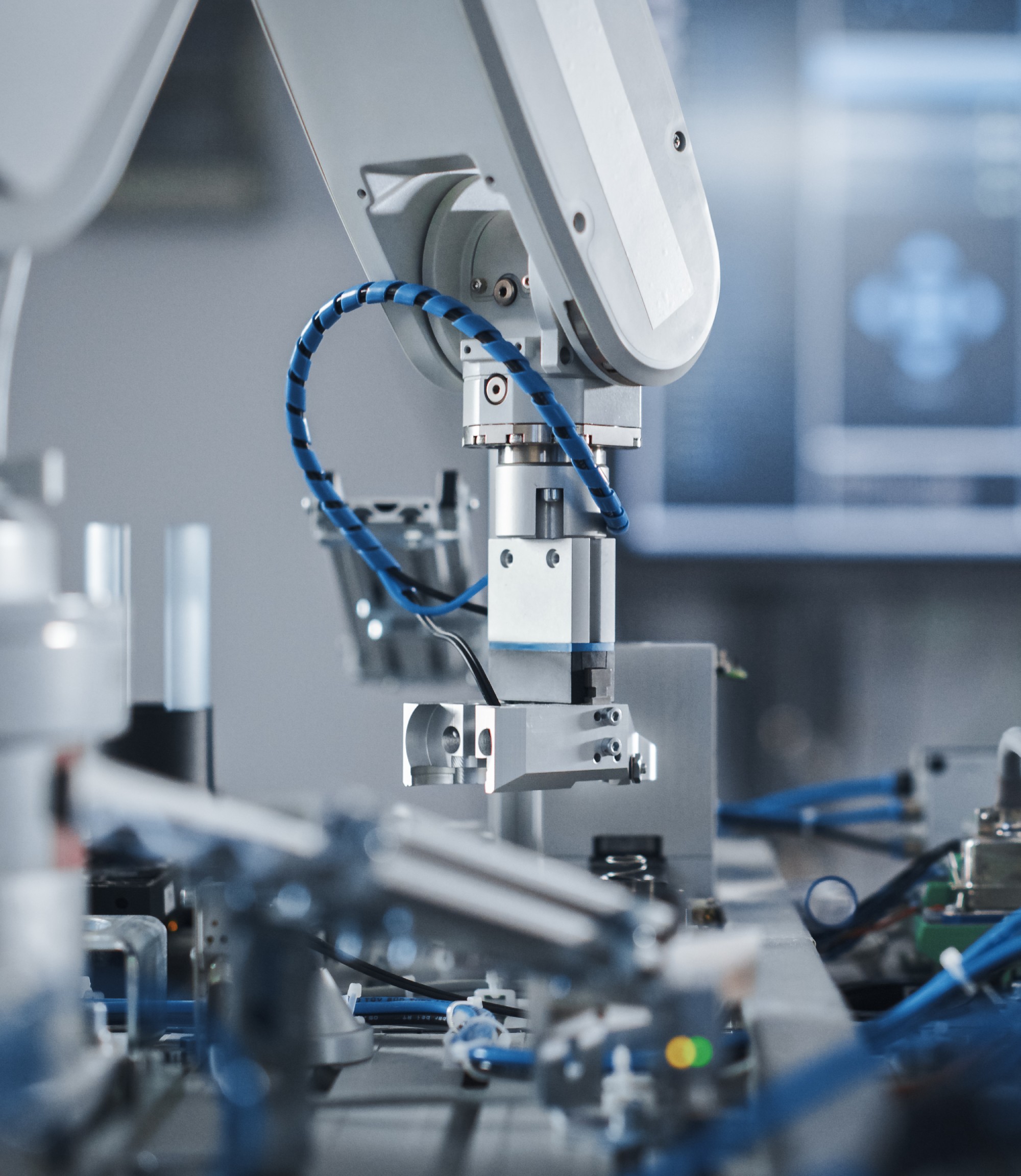

Asset finance can be used to purchase any asset that helps your business grow. This could include trucks, trailers, vans, cars, manufacturing machinery, construction equipment, recycling machinery, and agricultural equipment and much, much more. However, it is far easier to ask us what we can’t finance as this list is far shorter!

The main advantage of asset finance is that you get to pay for the asset over its working life which helps cash flow.

We provide products that tailor your requirements with examples being:

- Hire purchase – this is a simple way to buy an asset and spread the cost over a defined amount of time. You’ll pay for it in instalments via simple payment plan tailored to suit your budget and cashflow requirements

- Finance leasing – a finance lease works as a rental agreement. We buy the asset you need and rent it to you over the duration of the lease contract. That means you have it straight away, and only need a fraction of the total amount up front

- Asset equity release – this is a finance solution that enables you to raise capital for your business by securing a loan against your high value assets – traditionally machinery, equipment or vehicles

Our products offer great benefits in terms of cost efficiency and agreements are fixed and cannot be withdrawn.

Simply deals with companies of all sizes in the UK, and many of our customers are SMEs.

Yes, we can. Whether you are a new-start company or a company that wishes to release capital from existing owned assets, we are here for you. Many of our specialists have joined our business from the industries that they now lend into, so we do really understand where you are coming from.

Yes, we can. We pride ourselves in helping UK business and we have a can-do attitude. We are non- bank owned so it is always worth having a conversation and we will try our best to help the success of your business.

Yes. Typically, our minimum loan size is £5000 rising to a maximum loan size of £10m plus.

Yes, we do. You can contact us on 0208 0495 575 or email us on brokers@simply.finance if you would like to join our network.

Yes. Each agreement is aligned to each asset however we can also fund multiple assets on the same agreement.

Each application is considered on its own merits and tailored to suit the company’s actual requirements. Asset finance is sometimes considered to be a more flexible way of acquiring critical assets to help companies grow.

Our services —

Find out which product is right for you, and if you’re still unsure give us a call on 0203 369 6000 or contact us for help and advice.

A simple way to buy an asset and spread the cost over a defined amount of time.

- More flexible than a conventional loan

- Regular monthly payments

- Flexible repayment structure

- Possible tax relief on capital purchases

- VAT can be reclaimed if you’re VAT registered

A finance lease works as a rental agreement. We buy the asset you need and rent it to you over the duration of the lease contract. That means you have it straight away, and only need a fraction of the total amount up front.

- Access equipment quickly without significant initial investment

- Lease payments and periods can be designed to match cashflow

- Decide what to do at the end of the rental period

- Decide what to do at the end of the rental period

Equity release is a finance solution that enables you to raise capital for your business by securing a loan against your high value assets – traditionally machinery, equipment or vehicles.

- Suitable for companies of all sizes

- Consolidate costs and potentially reduce monthly outgoings

- Allows continued use of existing assets whilst introducing working capital back into your business

- Manage cashflow more effectively

- Can be used to raise deposits for or buy new assets such as software that may not be suitable for finance

- Can be used to consolidate existing financial commitments

Hire purchase

A simple way to buy an asset and spread the cost over a defined amount of time.

- More flexible than a conventional loan

- Regular monthly payments

- Flexible repayment structure

- Possible tax relief on capital purchases

- VAT can be reclaimed if you’re VAT registered