Technology with a handshake —

Simply Connect

Simply Connect is an end-to-end digital journey that allows us to serve our customers when they need us, in the way that works for them. It offers online tools for customers and brokers to manage their funding, from application through to the final payment.

From the beginning, Simply’s products and service have been built around the belief that SMEs deserve better

We have automated the funding process and removed the need for paperwork or manual input. With all our data sources integrated, we can approve applications without asking our customers to collect everything for us.

Simply Connect includes –

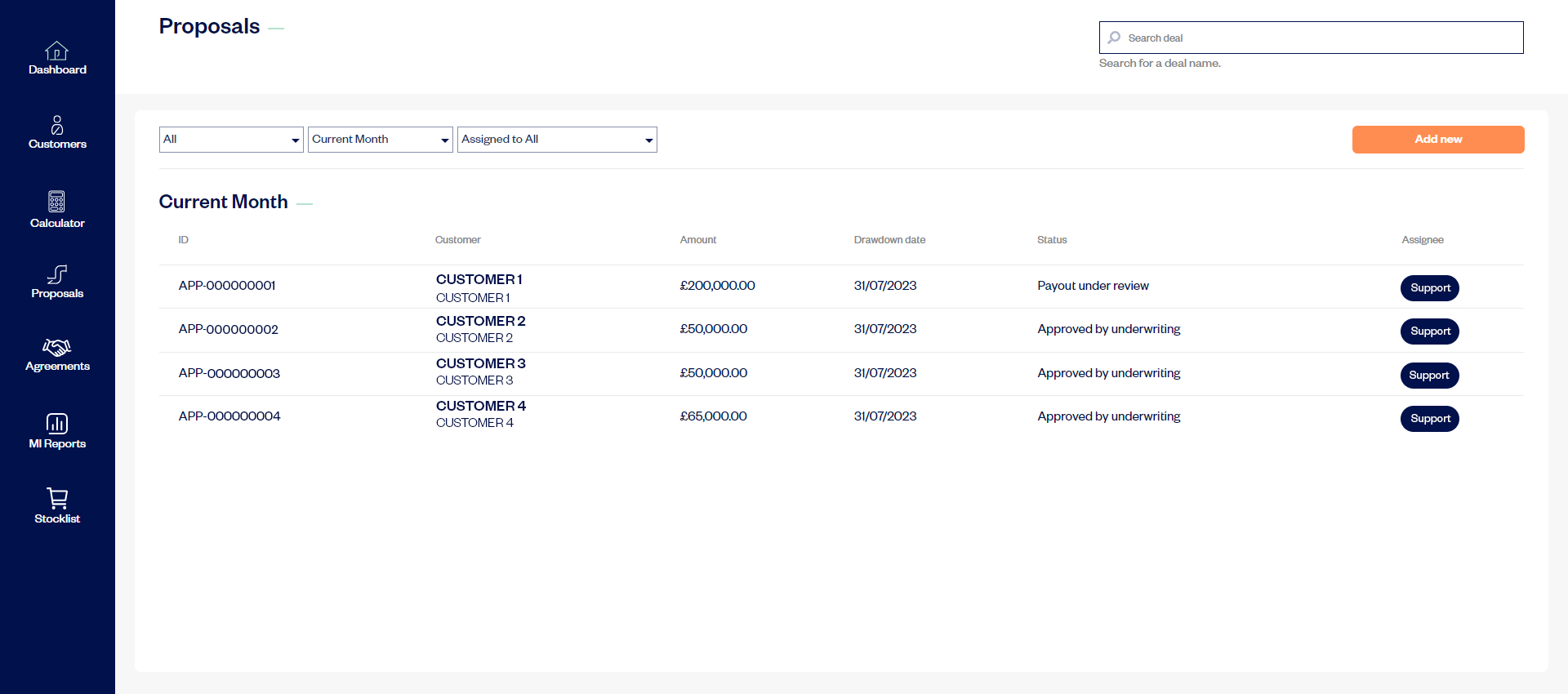

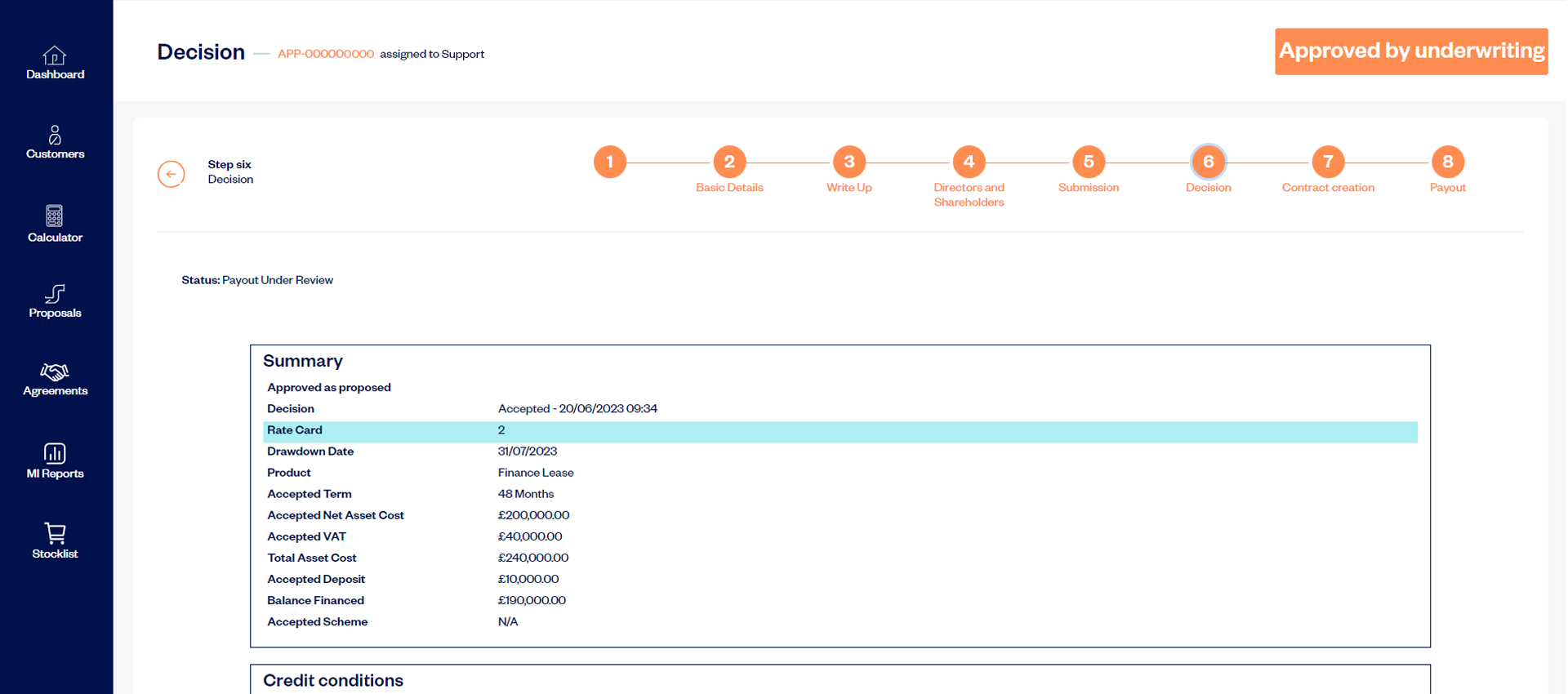

- Portals to submit applications

- Integrated credit data sources

- Integrated asset data sources

- Automated KYC and customer ID verification

- Electronic documentation

- Automated payment of funds

- Electronic welcome pack

- An app for customers with built in customer service functionality

- An app for broker partners with built in customer service functionality

- Asset value analytics to help customers optimise their funding

- Online market for asset sales

- E-signature and open banking

Most importantly, Simply Connect complements our award-winning personal service. This includes our readiness to talk over the phone, and our willingness to visit our customers to discuss their business objectives, growth, and funding opportunities. At Simply, we know trusted relationships cannot completely be replaced by technology.

By remaining flexible and accessible on the customers terms, Simply Connect empowers our customers to grow and prosper, utilising refinance and equity to build their businesses according to their own specific needs.

We call this technology with a handshake.